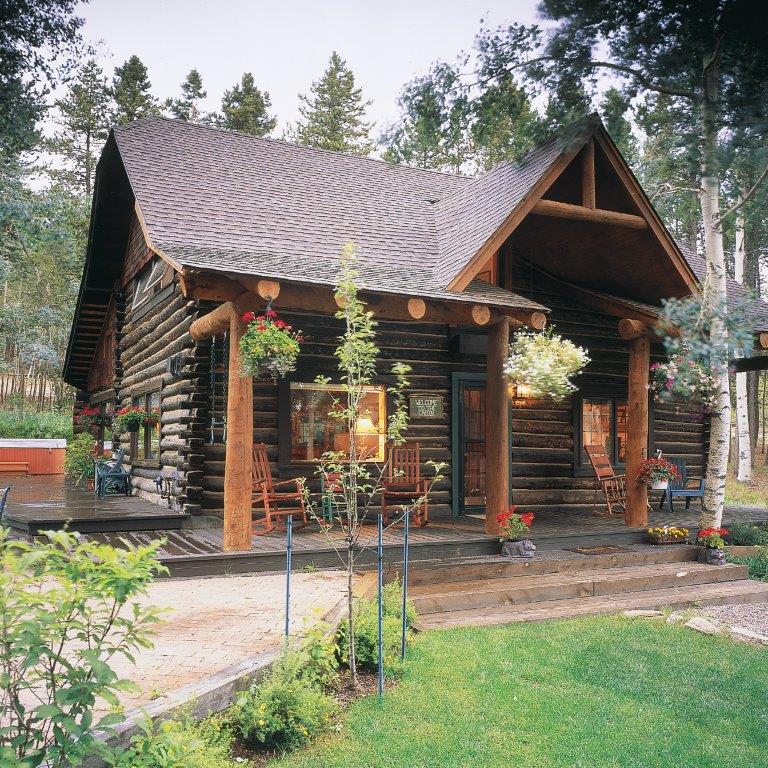

Financing A Log Home, What You Need To Know!

If building a log home is on your agenda, then you are to be envied! Log homes offer a kind of warm ambiance you just can’t find with any other style of home. Acquiring a log-home is a detailed process as it is with any type of home; and when it comes to financing a log-home, there are some important insights you should be aware of. We’ll cover only a handful here, but if there is one bottom-line message regarding financing, it would be this: Do plenty of research long before you plan to build. Collect as many questions as possible derived from your independent research and make sure you have all your inquiries clearly addressed from lenders, possibly a mortgage broker and, of course, log-home experts.

Financing a Log-Home

Lenders Have Hesitated With Log-Home Construction Loans:

Yes, it’s true—traditionally, lending officers have been reluctant to embrace log-home construction loans verses traditional home-construction loans for two main reasons: 1) there is a predictable shortage of log-homes in any given residential area to make accurate value comparisons and 2) often times, when log-homes are built in neighborhoods, the log-home owners will either under or over-build which, again, presents challenges with establishing a realistic market value for the home.

Mortgage lenders that cater to log-homes are not as prevalent as their traditional counterparts; but that trend is changing for the better. A good way to locate these specialized lenders would be to, first, contact a log-home manufacturer. Manufacturers, frequently, know who provides these particular services in or near the community. You can, also, contact larger banks since many choose to partner with niche` lenders.

Seek The Expertise Of A Mortgage Broker:

Seeking insight from a mortgage-broker is a wise choice since he or she can seek out the best financial options for your particular situation. A mortgage broker has extensive connections with a wide variety of lenders and will make every attempt to find a lender that caters to log-home loans and find the lowest interest rates possible. The other option is for you, the buyer, to call a slew of lenders to compare their mortgage terms and rates.

The Loans:

If you have a lot that is paid off, you have a definite advantage since you can barrow against it. There are two criteria that must be in place: 1) the lot must be under 30 acres and 2) the lot must have utilities already established. ‘Lot loans’ can range from 5 years to 25 years with either fixed or adjustable rates that are reasonable. Some lenders will allow you to barrow up to 90% of the lot’s purchase price. If your lot does not meet the two criteria, above, it’s still possible to use it as a loan-source but you would be up against much higher interest rates and points.

The best type of construction loan is called a ‘single-close’ loan where permanent loans are built in. Many times, single-loans allow the recipient to alter rates or loan amounts once the home-construction is complete. Construction loans can be converted into a traditional mortgage after the home is complete. Construction loans operate in such a way where a certain percentage of money is paid out by the bank in exchange for verification that labor and materials were legitimately utilized towards each respective construction phase. On-site inspections are conducted by bank representatives during construction.

What To Expect From Lenders:

Lenders will probably require a down-payment of at least 20% in addition to exceptional credit and steady employment. Your credit-history as a log-home recipient may have to be more pristine than what is normally expected with traditional buyers since a log-home is considered a greater risk than a traditional home. If there were a default, for example, lenders know that subsequent buyers would be limited since log homes don’t appeal to the masses compared to traditional homes. As with any home-loan pre-requisites, lenders want to be certain you have the ability to comfortably make monthly payments on a regular basis—taking into account insurance and taxes. Lenders will require personal assets to be used as collateral—stocks, bonds, land, savings, expensive vehicles etc. are all fair game as collateral to appease the lending institution.

You’ll Acquire Two Loans:

Whether you build your log home yourself of have a professional do the work for you, you’ll acquire two loans: the construction loan and the standard mortgage loan. The construction loan is independent of the mortgage loan and is short-term and can be valid from 6 to 18 months. It can be offered to a professional-builder or an owner-builder.

Borrow More Than You Think You Might Need!

Borrowing just enough money that you think you might need for the construction loan isn’t altogether prudent since, realistically, unplanned situations can alter the amount of cash you will need to complete construction. Unintended surprises--such as more-costly excavation modifications, for example—can emerge and you don’t want to get caught underfunded. If this were to happen, construction can be severely stalled or worse, yet, foreclosures can result.

Building a home, from beginning to end is an emotional-filled journey. Making sure all goes well is very much dependent on how well informed the future home-owners are. Do the research, ask lots of questions and know that once you surround yourself with all the loan and construction professionals who will bring all the details together, you’ll be well on your way to enjoying that beautiful log-home that will become enjoyed and treasured for decades!